null

Now, as most of the 2020 blockchain predictions have settled in and the year is near its end, let’s review the highlights in the enterprise blockchain and digital assets space, especially in the financial services vertical. Measured by the quality of the projects in 2019, the companies originating them, and the projects’ complexity and advancements to date, it is safe to say that enterprise blockchain in financial services has a bright future and is prime for bigger adoption in 2020.

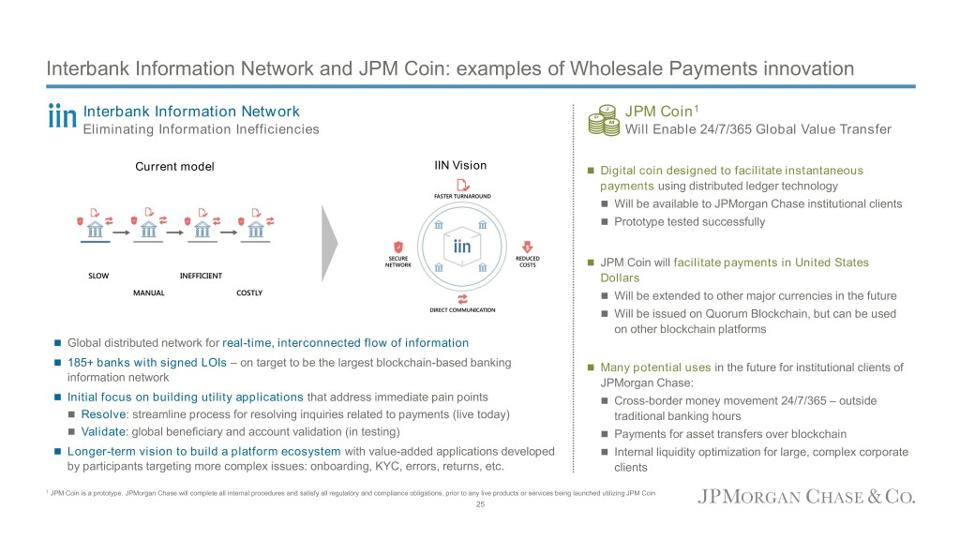

When the news in 2019 was dominated by projects like Facebook’s Libra, J.P. Morgan’s stablecoin and Interbank Information Network (IIN), Intercontinental Exchange’s Bitcoin futures Bakkt, and new European Central Bank (ECB) and China’s Central Bank Digital Currencies (CBDCs), it is easy to forget about ongoing projects that started earlier and silently kept delivering. The perfect example is the work that the Australian Securities Exchange (ASX) is doing to replace its CHESS with distributed ledger technology provided by Digital Asset to enable optimizations in equities clearing and settlement processes. The work is done using Digital Asset Modeling Language (DAML) and is moving through the project’s milestones without significant delays. Wider industry testing is expected to begin in 2020.

In terms of new blockchain projects, 2019 was the year for stablecoins, payment networks, and digital assets infrastructure. We saw the launch of Facebook’s Libra and while Libra was initially supported by 27 founding members within the Libra Association, after a series of U.S. Congressional hearings and perceived regulatory pressure, some of the biggest members, like PayPal, Visa, and Mastercard, left the project (for now). What remains certain is that the development work on Libra and Calibra, Facebook’s own wallet, is still proceeding as planned. I won’t be surprised if Calibra soft-launches in 2020 without its own stablecoin but supporting other fully regulated stablecoins like USDC, backed by Coinbase, for example.

Facebook’s Libra

As interest in digital assets grows, the infrastructure for securely holding and keeping bitcoin and other cryptocurrencies in a regulated and compliant manner is considered one of the major challenges for any institutional newcomer, regardless of size and trading volume. In 2019, we saw the entrance of significant players, as both Bakkt (backed by ICE and the NYSE) and Fidelity Digital Assets are able to provide safe-keeping and custodian services on top of other services. Additionally, custody was a hot topic throughout 2019, as we saw startups like Trustology trying to get in and hope for market share while the traditional asset managers and custodians like Vanguard, State Street, and Northern Trust were slowly building products, solutions, and partnerships.

In retail banking, and especially in the back-office services of settlement, reconciliation, transaction audit, and visibility, the most interesting developments in 2019 centered on stablecoins and CBDCs. We saw the launch of projects like J.P. Morgan’s own stablecoin and Utility Settlement Coin/Fnality, which is backed by banks like UBS, Barclays, and BNY Mellon, among others. The main purpose of these projects is to create a stablecoin that can be used by banks, as well as participants on their network, to transact and settle instantaneously and without friction while maintaining full visibility and predictability, with KYC/AML-enhanced transactions. IIN is particularly interesting as it plans to onboard more than 365 banks on its platform.

J.P. Morgan Chase IIN

One of the biggest news items at the end of 2019 was the announcements of China’s digital currencies and blockchain initiatives. This was quickly followed by new pilots, consortiums, and venture and government funding pouring into the blockchain space. The message was clear: China is serious about launching its Digital Currency/Electronic Payments initiative. While this was happening, Europe didn’t want to remain outside the innovation zone and quickly announced its EUROchain project while working on improving its digital assets regulation. Altogether, more than 18 central banks are seriously considering launching a digital currency project.

Central Bank Digital Currencies

Overall, the financial services space is seeing bigger and larger advancements in blockchain adoption as compared to other verticals, like healthcare and insurance. Still, there are many opportunities remaining to be realized and delivered, and the sentiment is more than positive. A simple glance at the names of the companies, large stakeholders and governments backing the enterprise blockchain space offers reassurance of its success in 2020 and onwards.