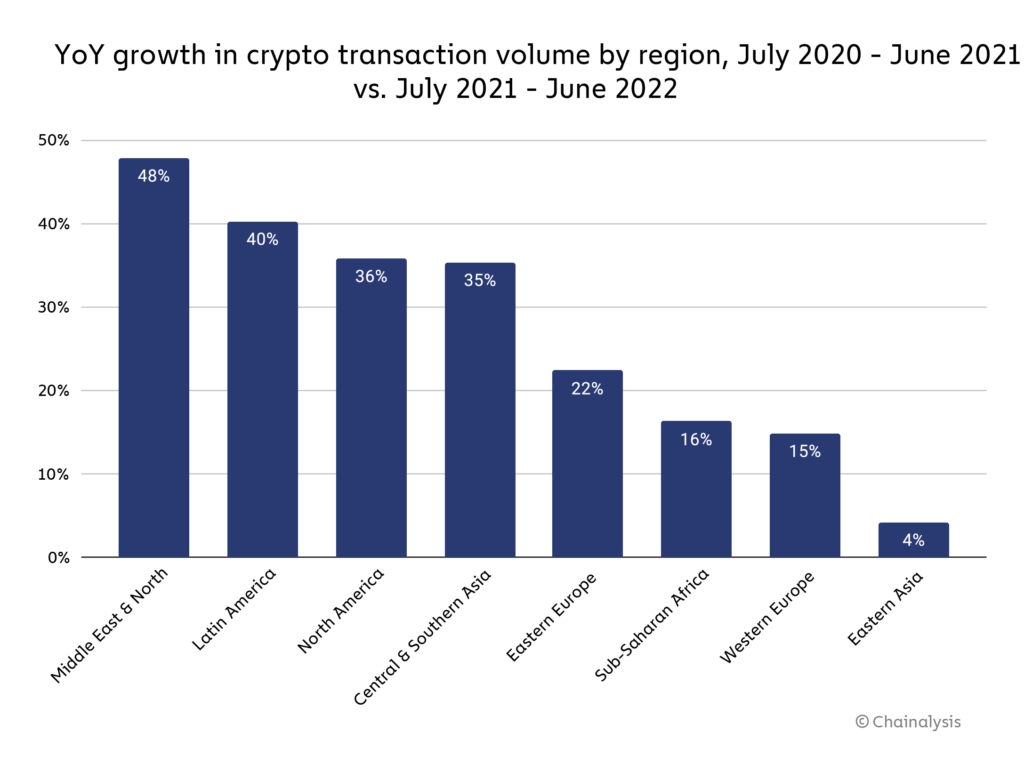

Despite being one of the smaller crypto markets in the 2022 Global Crypto Adoption Index, the Middle East and North Africa (MENA) is also the fastest-growing market, found a report by the major blockchain analysis company Chainalysis.

According to this latest report,

“MENA-based users received $566 billion in cryptocurrency from July 2021 to June 2022, 48% more than they received the year prior.”

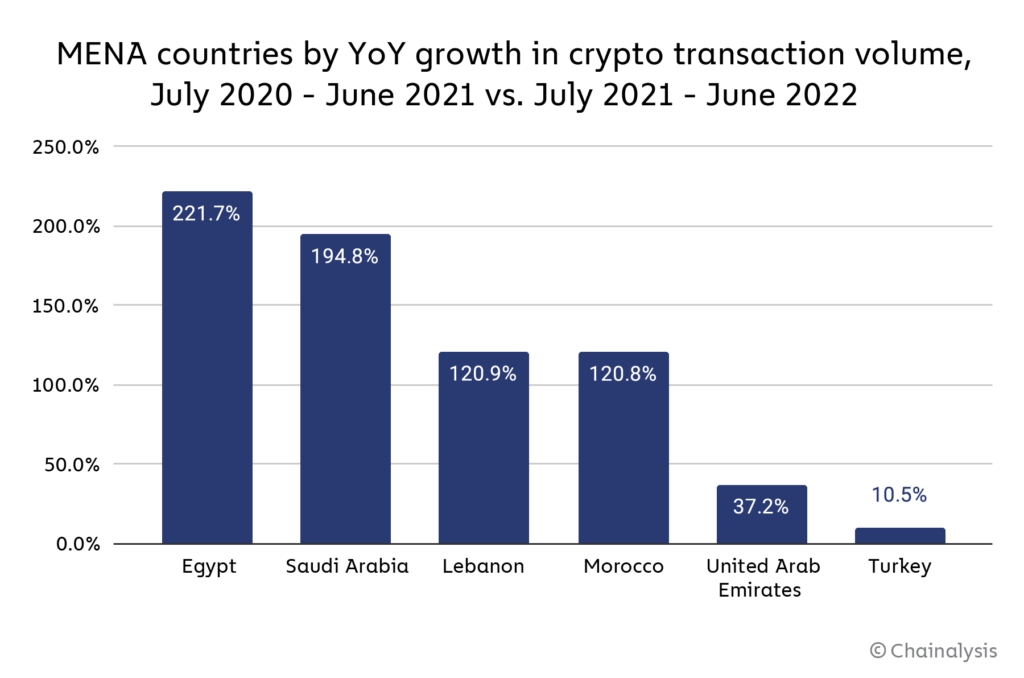

The report noted that MENA contains three of the top thirty countries in the company’s 2022 index: Turkey (12), Egypt (14), and Morocco (24).

Reasons behind this include use cases around savings preservation and remittance payments, as well as “increasingly permissive crypto regulations.”

Looking at these three countries in more detail, Chainalysis found that fluctuating crypto prices have overlapped with swift fiat devaluations in Turkey and Egypt, which in fact strengthened “the appeal of crypto for savings preservation.”

Turkey is the largest crypto market in the region, the citizens of which received $192 billion from July 2021 to June 2022. It, however, has seen “much slower” year-on-year [YoY] growth.

When it comes to Egypt, its remittance market is very significant. Remittance payments account for some 8% of the country’s GDP, while the national bank already started working on a project to build a crypto-based remittance corridor between Egypt and the UAE, where many Egyptian natives work, said the report.

It added that,

“Egypt’s position at the intersection of growing crypto remittances and increased inflationary pressures help explain why it’s the fastest growing crypto market in all of MENA this year.”

Between July 2021 and June 2022, it found, transaction volume in Egypt tripled compared to the year prior.

Lastly, when it comes to Morocco, Chainalysis found that “notable levels of grassroots adoption seem to be more tied to the government’s newly permissive crypto stance than to any particular macroeconomic tailwinds.”

It noted that the central Bank of Morocco partnered with the International Monetary Fund (IMF) and the World Bank earlier this year to create crypto regulations that “emphasize innovation and consumer protection.”

Meanwhile, a leader in the region when it comes to grassroots crypto adoption used to be Afghanistan. However, since the Taliban’s takeover last August, the country has fallen to the bottom of the list, ranking 20th in Chainalysis’ 2021 crypto adoption index.

The company argued that,

“The Taliban’s crackdown has had a massive chilling effect on the country’s crypto markets. Under current conditions, crypto dealers are left with three options: flee the country, cease operations, or risk arrest.”

The member states of the Gulf Cooperation Council (GCC) – Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman – are key business hubs of the MENA region, but they rarely get to the top of Chainalysis’ grassroots crypto adoption index, “as it weighs countries by purchasing power parity per capita, which favors poorer nations,” said the report.

That said, the report noted that the role of these countries in the crypto ecosystem shouldn’t be underestimated. Saudi Arabia is the third-largest crypto market in all of MENA, it said, while UAE is fifth.

____

Learn more:

– Turkish Inflation and Lira Woes Makes Crypto The Great Mitigator

– Turkey (Unintentionally) Builds Case for Bitcoin as It Plans to Convert Citizens’ Gold to Lira

– Greed Will Keep Crypto Alive, Egyptian Billionaire Naguib Sawiris Says

– DeFi Adoption Driven By Seasoned Traders, Investors From High-Income Countries – Report

– India’s Crypto Market is More ‘Mature’ Than Vietnam’s and Pakistan’s – Chainalysis

– Bitcoin, Crypto Represent Hope and Despair Amid Afghanistan Carnage