Only 10 years ago, no one knew what a blockchain was. Today, there are hundreds of well-established and emerging cryptocurrencies using blockchain technology to supplant traditional fiat money and change the way we live.

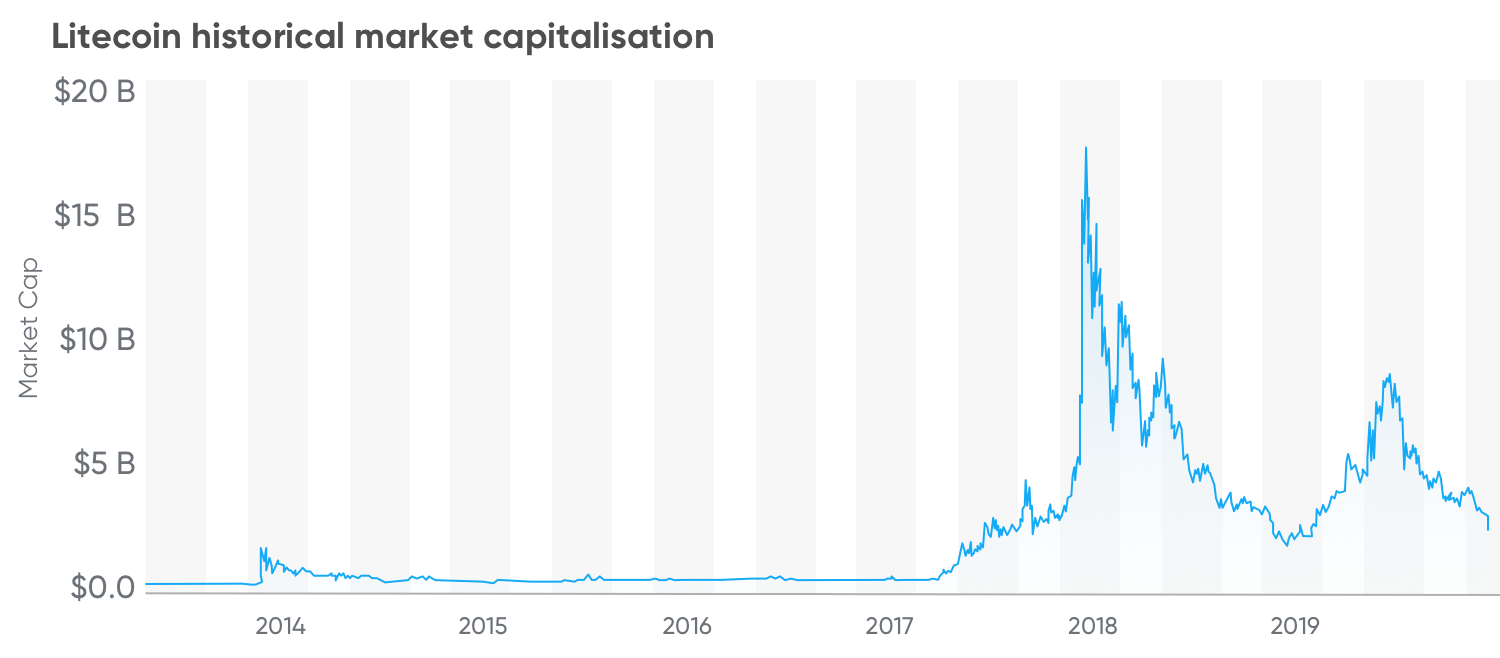

Litecoin (LTC) has drawn a lot of investor interest after hitting the headlines in December 2017. Then, the cryptocurrency reached its record high of $375, an 8,200 per cent increase year-on-year, hitting a total LTC market cap of $19.5 billion.

However, following the latest crypto market news where prices have fallen across the board, many now wonder: will Litecoin go up once again? Can it fully recover and set some new records after the bumpy ride of the second half of 2019?

While this year is about to come to an end, closing the first decade of crypto’s existence, analysts are split in their Litecoin price predictions. Some experts say that its current all-time high could be just a drop in the bucket and predict the coin to hit an overwhelming $595 by 2030. Others take a bearish stance, believing that another crypto winter is yet to come, with Litecoin future price dropping as low as $1.5 by the end of 2024.

So, if you are wondering, “should I invest in Litecoin or not?” we have you covered. In this article, we try to find the truth by taking a closer look at what factors influence this cryptocurrency, reviewing its recent performance, analysing the latest developments and checking out the Litecoin price prediction for 2020 and beyond.

The very basics: what is Litecoin?

Before we delve deep into the Litecoin price predictions, let’s do a quick review on what LTC is.

On October 7, 2011, Litecoin (LTC) was created by Charlie Lee, an ex-Google employee and former Engineering Director at Coinbase. Designed as a peer-to-peer network with the same-name native cryptocurrency, it was launched to complement Bitcoin by solving issues like concentrated mining pools and transaction timings, as well as to make the crypto world more accessible.

Truth be told, these two do share a lot in common. However, there are still some substantial advantages that Litecoin boasts of. These include, among others, improved capacity, faster block generation and higher supply limits.

On the other hand, as Litecoin’s purpose initially was to be “silver” to Bitcoin “gold”, some sceptics call into question whether it will ever be able to become anything more than its main rival. While Litecoin technically has a superior algorithm, it may be rather irrelevant since Bitcoin’s popularity has cemented it as the gold standard for old and new crypto traders. Moreover, the next-gen altcoins are emerging almost daily, taking the industry’s competition to a whole other level.

Litecoin price analysis: the rise and fall of the alt-legend

After its launch, Litecoin was fast to get the attention of the small yet growing crypto community of the time. Nonetheless, its value had remained rather low – around $3 – for quite a long time. It was only in November 2013 when the market finally saw the first significant price movements. On November 28, LTC value almost doubled within one day and reached the price of $50 per coin.

However, such a substantial jump was short-lived. In April 2014, Litecoin dropped to $10 and further to a little over $1 in February 2015. The crypto was then traded in the range of $1-$4 for the next two years.

In March 2017, Litecoin announced the launch date of their Segregated Witness (SegWit) protocol upgrade. The statement had a positive impact on the coin’s rate, with its value rising to $16. In May, the protocol changes were finally implemented, making LTC the first of the top five cryptocurrencies to adopt SegWit and pushing its price to $30.

Meanwhile, the dev team implemented the Lightning Network, attracting a lot of attention from the crypto enthusiasts. By September, LTC reached $70. With the whole market being bullish, sending Bitcoin and altcoins to set new price records, Litecoin hit its all-time high of $375 in mid-December.

For the most part of 2018, Litecoin was in a bearish trend. Despite its well-established position in the industry, the coin was affected by the overall descending dynamic of the market. The downward Litecoin trend only changed a couple of times: in February and April. All-in-all, the coin’s price decreased almost five times over the course of the year.

At the end of 2018, things started getting better, and Litecoin managed to stabilise, finally gaining an upside momentum.

At the beginning of 2019, Litecoin continued its price growth. During the first half of the year, LTC price increased four times from $31.02 to $138.4. The reason for such a significant price hike was the upcoming Litecoin halving, which happened on August 5.

However, the event was followed by the much-expected correction, with the price of Litecoin dropping as low as $68 by mid-September. Throughout the rest of the year, the coin remained in the downward trend. At the time of writing, on December 20, LTC traded at $40.

What can determine Litecoin future price: does LTC stand a chance?

Back in the days, Litecoin was at the forefront of modern and relevant technologies. Its early implementation of SegWit protocol and Atomic swaps has revolutionised the sphere of the cryptocurrency payments.

However, Litecoin has been recently struggling with many difficulties. Now that Bitcoin also introduced SegWit, the altcoin lacks one of its crucial competitive advantages.

Joe DiPasquale, CEO of cryptocurrency hedge fund manager BitBull Capital, said: “Litecoin’s price action has historically followed Bitcoin’s, but currently it is facing negativity on multiple fronts. In the absence of new capital flow, transaction volumes have remained tame and the August halving has failed to push the price higher.”

He also added: “In fact, miners have begun to abandon the network after the reward-reduction, which is why the hashrate is falling and concerns are being raised about the network’s security.”

Marouane Garcon, managing director of crypto-to-crypto derivatives platform Amulet, also weighed in, saying that Litecoin’s recent price decline “has more to do with the concerns about development and how they are going to be funded going forward.”

Earlier this year, Charlie Lee reportedly told Franklyn Richards, director of Litecoin Foundation, that “no one is interested in working on Litecoin protocol development work.” After this information was disclosed, “people’s perspective of Litecoin changed,” continued Garcon. “Litecoin has not been the same since that announcement,” he added.

“It threw everyone into a panic. If no one is willing to work on Litecoin and develop it then why should anyone invest in it?”

Based on the latest study conducted by Sylvain Saurel, the potential of Litecoin is very limited. He explained that the coin peaked in 2017 as it was riding on Bitcoin’s wave of success, taking advantage of the increasing number of interested investors. Although Litecoin remains in the top 10 cryptocurrencies by market cap, this number is still too far from its record high of $19 billion.

Saurel claims: “Litecoin will certainly remain in the top 10 of cryptocurrencies for some time to come, but its future is clearly not alongside Bitcoin that could revolutionise the monetary and financial system in the future.”

Litecoin has reported a decrease in its hashrate since mid-2019, reaching its lowest levels since 2018.

At the time of writing, its hashrate was 147.4 TH/s. If the fall is prolonged, it could negatively affect the future performance of Litecoin.

However, it is important to note that the network is now working on some major changes. According to the latest news, the Litecoin Foundation is currently cooperating with Steve Burkett, a developer of the Grin project, to implement MimbleWible in the Litecoin protocol. Once realised, Litecoin could move away from Bitcoin, creating a unique selling point. On the other hand, innovation will reduce fungibility, possibly making Litecoin susceptible to being blocked from important exchanges.

All in all, Litecoin has a great advantage to make improvements to itself much faster than Bitcoin does. However, with the rapid development of new crypto projects that have base codes that are already more fit for micro-transactions and scaling, has Litecoin missed its chance to stay on top?

Litecoin price prediction 2020 and beyond: what to expect in the following decade

It is no secret that the crypto market moves at a rapid pace, making it rather difficult to predict its future. We have made our own investigation to compile a list of the latest Litecoin forecasts from various sources.

Based on technical analysis, TradingBeasts.com, a popular crypto forecast website, predicted that by the end of next year, LTC price will be around $46.23; and only a bit higher in 2021 – up to $67.23. By December 2022, Litecoin is expected to grow to an average of $82.68.

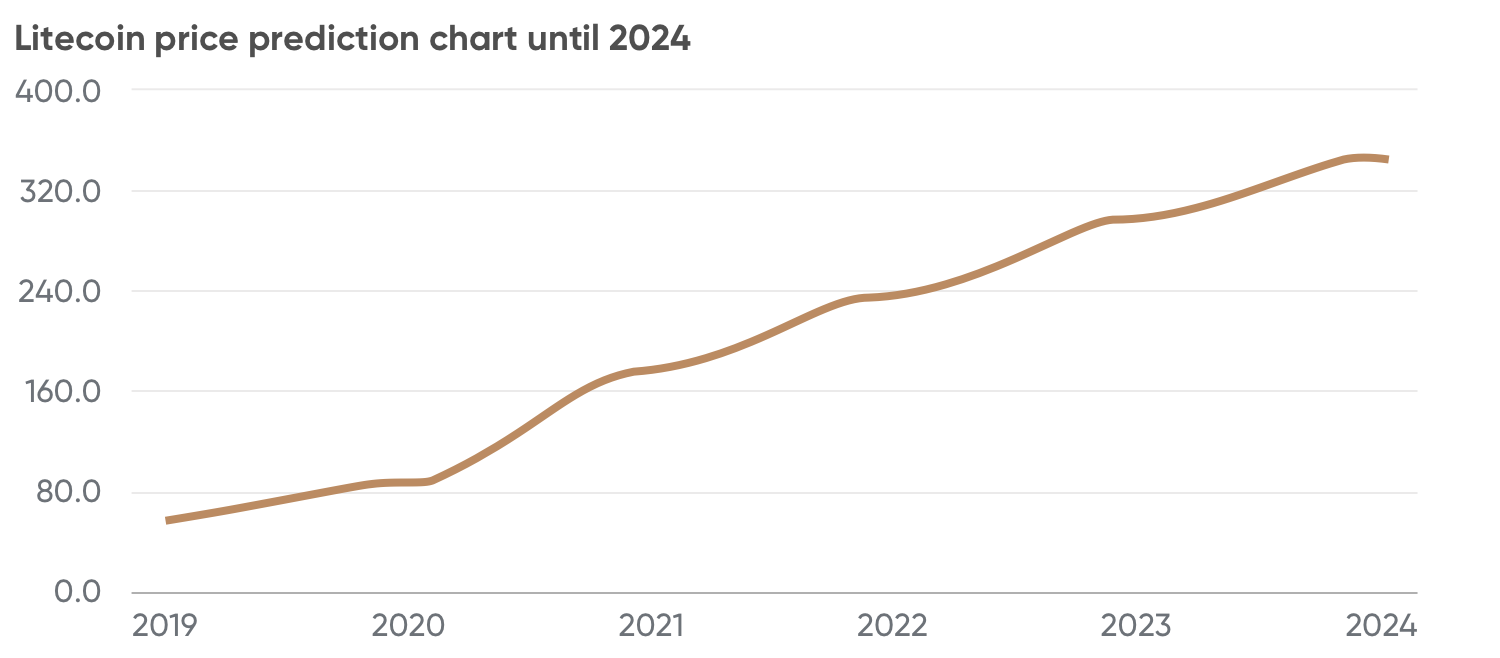

A more optimistic LTC price forecast is provided by Cryptoground.com. Based on an internal deep learning algorithm, it states that LTC will reach $88.30 in one year, rising almost 109.81 per cent. It is expected that the growth will continue, with the coin trading at $347.8 by the end of 2024.

According to the information provided by CoinFan.com, another famous online forecasting service, Litecoin future predictions look rather promising, with LTC prognosed to end 2020 at $276.4. Their long-term forecast suggests the coin will hit $506.8 by May 2025.

George Tung, a cryptocurrency analyst, has the most positive Litecoin projections, saying its price might rise as high as $1,500 towards the end of 2020.

Looking forward, DigitalCoinPrice.com states that Litecoin will have moderate price growth. The positive trend is expected to prevail, with the coin trading at $72 in December 2026.

Regarding the Litecoin price prediction 2030, the coin is expected to end the following decade at $251.44, according to CoinPriceForecast.com.

However, not everyone has taken a bullish stance. Walletinvestor.com, known for their pragmatic forecasts, refers to LTC as a “bad, high-risk one-year investment option.” According to their Litecoin predictions, the coin is expected to lose in value significantly, with its price falling to $4.5 by August 2020. However, it is expected to recover by fall and end next year at $36.8.

In five years, Wallet Investor estimates the coin to drop as low as $0.77 by the end of 2024.

The bottom line: is it worth investing in Litecoin?

The crypto market has experienced several ups and downs over this year. While all the talks revolve around digital money, there are still many questions to answer.

Will Litecoin rise and live up to the expectations of analysts? As you can understand, there is no definite answer to this question. It is very difficult to predict what the price of Litecoin could be in a few hours; and even harder to give long-term estimates. However, according to the forecasts mentioned above, LTC is mainly prognosed to move in a positive direction.

Is Litecoin a good investment for the long term? Well, many crypto enthusiasts believe that the project has the technological strengths that could help it to become even more popular in the crypto world.

When choosing what cryptocurrency to invest in, it is always crucial to consider the latest technical analysis, expert opinion and market trends. For that, we recommend you do as much research as possible.

If you think you are not ready to make long-term investment commitments, but still want to try to profit from the market volatility, you can do so through contracts for difference (CFD).

You can learn more about CFD trading with free online courses and find out how to trade Litecoin CFDs by reading our comprehensive guide. Always stay on top of the Litecoin latest news with Capital.com.

So, what do you think about the future of this digital coin? Will Litecoin go down or soar to hit new record highs? Do you have an LTC price prediction of your own?

Follow our live LTC/USD chart and make your own bets!