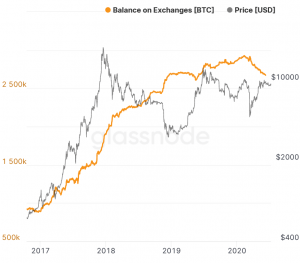

Bitcoin (BTC) balances held on exchanges continued down, reaching a 13-month low today. Meanwhile, a blockchain analyst suggested investors should use caution in how they interpret on-chain data.

The new low in exchange balances was reported by blockchain analytics firm Glassnode, which said on Twitter today that the 13-month low of about 2.62 million BTC held on exchanges is a further step down from June 30, which saw 2.63 million BTC held on exchanges.

As previously reported by Cryptonews.com, exchange balances have been in decline for the better part of 2020. Meanwhile, several theories have been discussed as the reason for the move away from exchanges, with some insiders pointing to over-the-counter (OTC) deals, while others have said an increase in the bitcoin whale population shows that large holders increasingly prefer to take full control of their own coins.

And although 2020 has seen a decline in exchange balances of bitcoin, the downtrend is still a relatively new phenomena for bitcoin, which can be seen when zooming out on the longer-term chart back to 2017. Since then, exchange balances have pretty much been in a continuous uptrend, with relatively minor pullbacks along the way.

Meanwhile, Rafael Schultze-Kraft, Chief Technology Officer (CTO) of Glassnode, suggested in a recent podcast with Stephan Livera that on-chain data should not necessarily be taken at face value, as it is “very difficult” to estimate things like how many people are “hodling” bitcoin.

“This is a question that has been very difficult to answer because what the approximation has been until now is simply to look at addresses,” Schultze-Kraft said, adding that the problem with that is that one user can control more than one address.

“And there’s also addresses that hold funds of multiple users. Think about an exchange address for instance,” the Glassnode CTO explained.

Further, Schultze-Kraft also supported the idea that the reduction in exchange balances is driven by whales taking their coins off exchanges, saying that the growth in whale numbers is “essentially inversely related to the amount of BTC that is being withdrawn from exchanges.”

However, the CTO also warned that the explanation for this is not necessarily as simple as just to say that whales are learning how to do self-custody, saying it’s probably “too easy” to reduce it to that.

“[…] at least to some extent that withdrawal of funds from exchanges is potentially now a setup of real confidence that you know they will be holding their coins for a large amount of time, you know, in anticipation potentially of a bull market,” he said.

At pixel time (12:00 PM UTC), BTC trades at USD 9,207 and is down by 2% in a day. The price is up by almost 1% in a week, trimming its weekly losses to less than 6%. BTC dropped by 20% in a year.