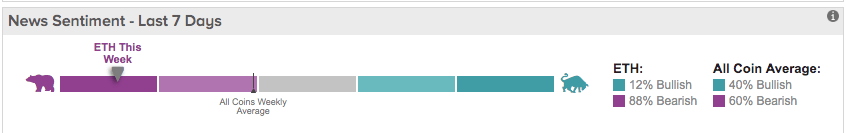

The sentiment around Ethereum has shifted from ultra bullish to bearish in less than a month.

On June 26, investors were extremely bullish as the No. 2 cryptocurrency as its price rose from a 2018-bottom of $83 to the 2019-high of $363.30. That’s a massive gain of over 337 percent in six months. Since then, Ethereum has been plunging and media outlets have been overwhelmingly bearish on this altcoin.

Nevertheless, a 40 percent-plus nosedive from the yearly high as the crypto token is trading close to $200 can be healthy for the long-term outlook of the market. We looked at the charts and two things are clear. First, an Ethereum bounce could be on the horizon. Second, the long-term uptrend of the coin remains intact due to robust fundamentals.

Ethereum Bulls Look Ready to Strike Back Hard

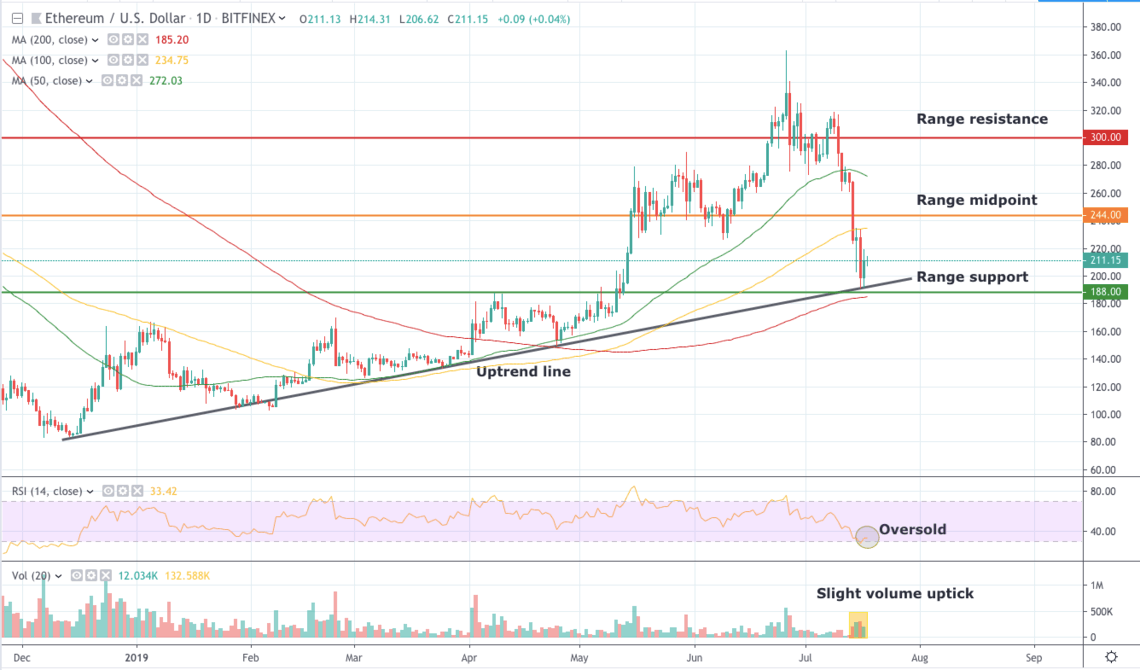

Ethereum looks like it may have more downside potential. However, a close examination of the daily chart shows that bears are overextended and bulls are exploiting the situation.

First, we see the cryptocurrency barely touch our range support of $188. On July 16, the market dropped to $191 and buyers quickly responded by buying the dip. Bears even attempted to drive the price back down on July 17 but bulls pushed back hard and sent the cryptocurrency to as high as $219.47 on the same day.

We attribute the recent bounce to oversold conditions on the daily RSI. We are seeing selling relief as market participants appear to lose interest in dumping the coin at current levels. With supply drying up, buyers appear to front-run each other once again. The slight volume surges over the last few days validate this assumption.

Market participants are doing this because they can see that Ethereum is being buoyed

by three supports around $188. The first one is the horizontal support or our range support. The second is the diagonal support which tells us that the uptrend remains intact. Lastly, we have the 200-day moving average acting as an additional cushion.

With these three key supports being respected, it is possible that the cryptocurrency will resume its uptrend and bounce to our range midpoint of $244 at the very least. Above that, the next target is $300.

We have trader Scrembo Paul providing an in-depth analysis on Ethereum that matches our target price:

Ethereum Fundamentals Remain Strong Despite the Correction

If you’re still doubtful of the cryptocurrency’s ability to reassert its bullish steam, then perhaps you should consider its strengthening fundamentals.

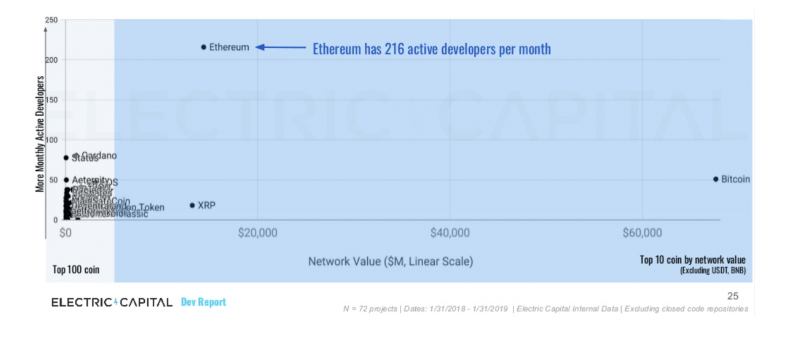

Ethereum leads all cryptocurrencies in terms of the number of active developers per month by a huge margin. An Electric Capital report reveals that the No. 2 cryptocurrency has 216 active developers per month. That figure is more than four times the number of active Bitcoin core developers per month.

With more active developers, Ethereum is in a great position to lead all cryptocurrencies in innovation and rate of development.

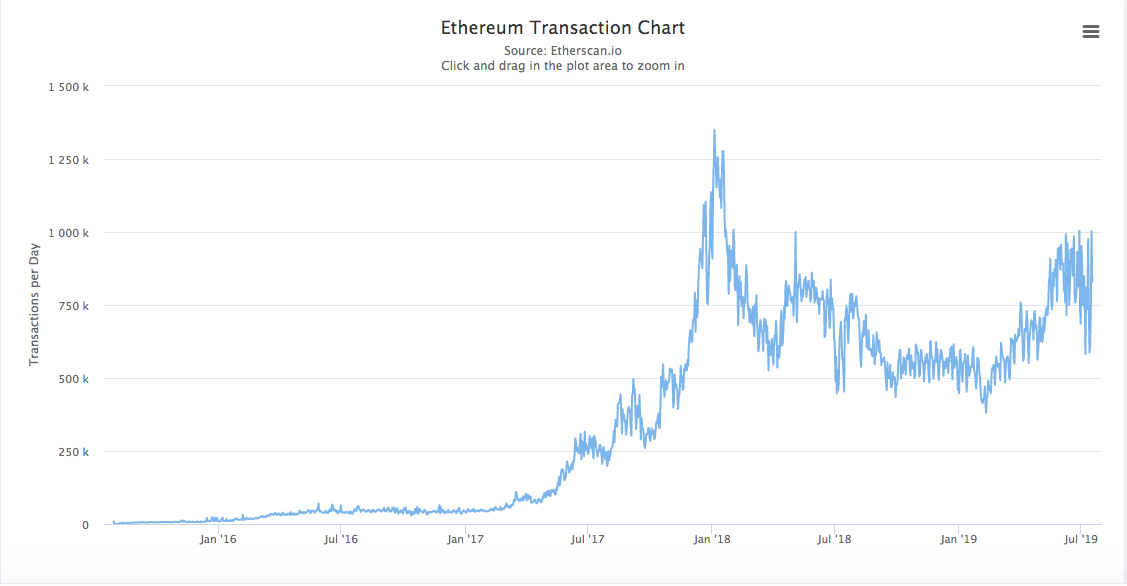

In terms of demand, Ethereum is also flexing its muscles.

Etherscan reveals that the number of transactions per day is on the up and up. The crypto token is hovering close to 1 million transactions per day, which is a steep rise from the below 500,000 daily transactions number at the start of the year.

Bottom Line

Ethereum may have dumped but it looks like the worst is over. As this round of correction concludes, it’s possible the cryptocurrency will resume its uptrend due to technical analysis and strengthening fundamentals.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.

This article is protected by copyright laws and is owned by CCN Markets.

Be the first to comment